Give to ODCS for Free

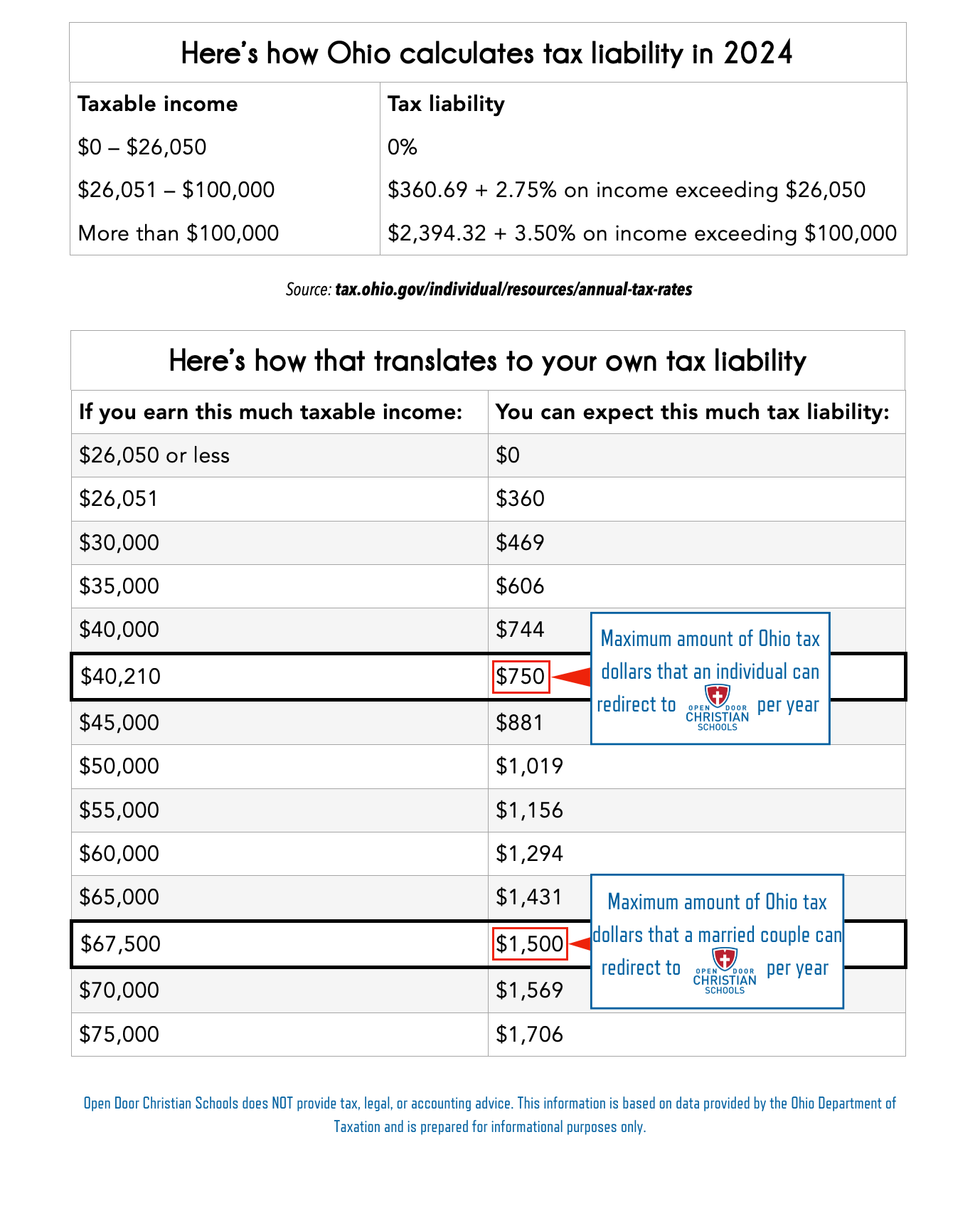

Do you pay Ohio state tax? If so, you can divert up to $1,500

of it towards an ODCS Scholarship instead!

Did you know taxpayers have a cost-free way to provide significant scholarships for students to attend Open Door Christian Schools (ODCS)? Thanks to Ohio’s new state tax credit, individuals who donate through OCEN, our Scholarship Granting Organization (SGO), can receive a dollar-for-dollar state tax credit up to $750.

HOW IT WORKS

$750 Donation = $750 Tax Credit

Donations can be made through OCEN, our Scholarship Granting Organization, and may be claimed when you file your Ohio taxes for the year in which you make your gift. The credit is a dollar-for-dollar reduction in your state tax liability up to $750 per taxpayer. A married couple filing jointly can make two gifts and claim a credit of up to $1500.* To receive the full tax credit, you must have an Ohio tax liability equal to or greater than the amount of the credit. When you designate your gift for ODCS you are providing scholarships for students to attend or stay at Open Door Christian Schools.

* Contact your tax professional with questions specific to your tax situation.

Does It Make Sense for Me?

Is it too good to be true?

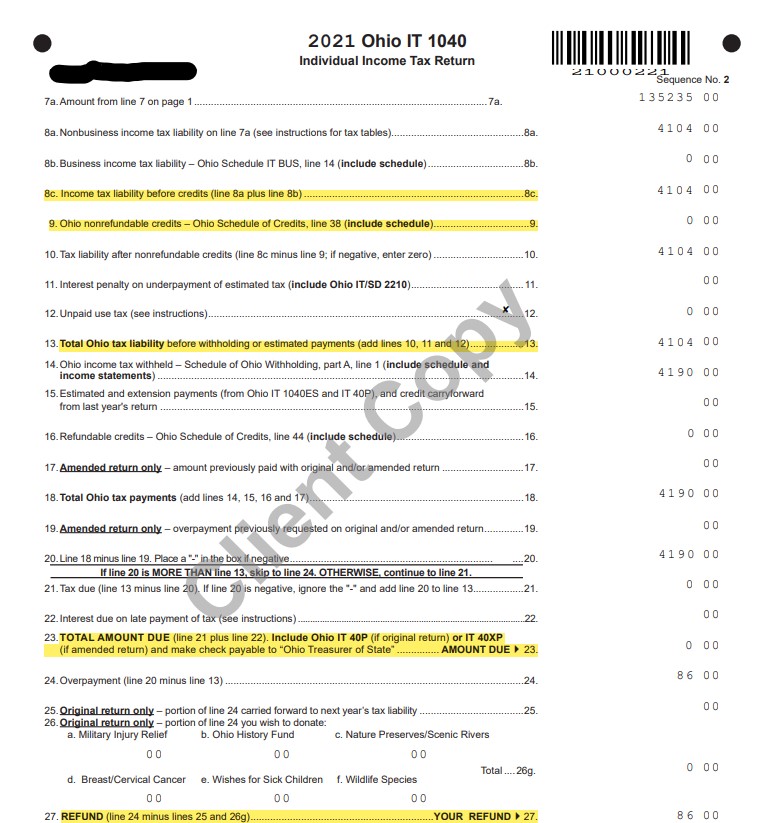

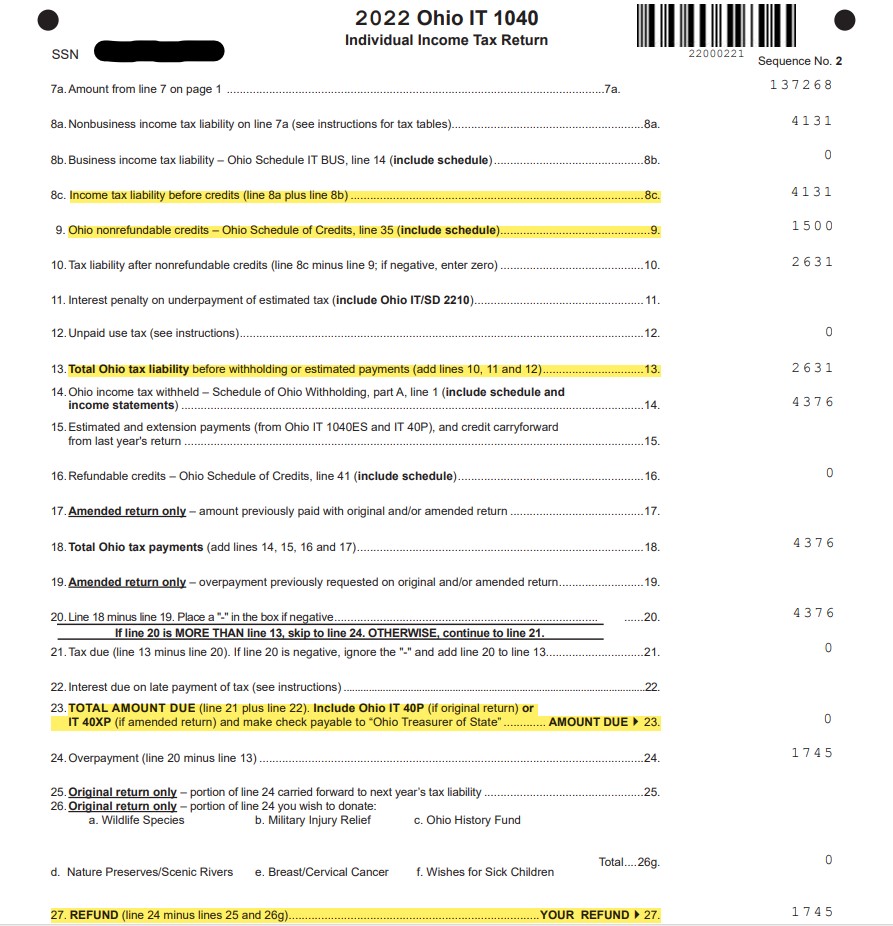

Most people pay taxes to the state through estimated deductions from their paycheck. If you paid too much during the year you receive a refund. If you didn't pay enough you will owe more at tax time. Line #8c on form Ohio IT 1040 shows your actual tax liability. Tax credits directly reduce the number on line #8c.

Assuming all things equal, the following year the same couple may make separate $750 contributions to OCEN, our Scholarship Granting Organization, and receive it all back when they file their taxes.

Point to Remember

- Find Line #8c on your Ohio IT 1040 form.

- If the number on Line #8c is greater than $0 and you anticipate a similar or increased tax liability, you may contribute that amount from Line #8c (up to $750 per individual, $1,500 for couples) to OCEN to provide a scholarship for students to attend ODCS and received a dollar for dollar credit equal to that.

- The credit is non-refundable. So, if the number on Line #8c is $342 and you contribute $750, you will only receive a credit of $342.

- If the number on Line #8c is $0 but you feel the Lord is calling to support the ministry here at ODCS, consider becoming a Patriot Partner.

- If you are feeling led to gift more than $1,500, consider these options:

- Become a Patriot Partner

- Become a Patriot Provider (Patrons committing gifts of $6,000 or more for the specific purpose of tuition assistance).

- Make a matching gift during our Growing Excellence Plant Sale